Tokenização de ativos

A tokenização de ativos de investimento é um processo que está revolucionando o mercado financeiro. Eles podem ser usados para representar participação em um ativo, como uma ação, um título ou um imóvel.

Dê o primeiro passo e saiba mais!

Mercado Reinventado

A tokenização de ativos de investimento é um processo inovador que envolve a conversão de ativos financeiros tradicionais em tokens digitais. Esses tokens são então armazenados em um blockchain, que é um registro digital distribuído, descentralizado e imutável.

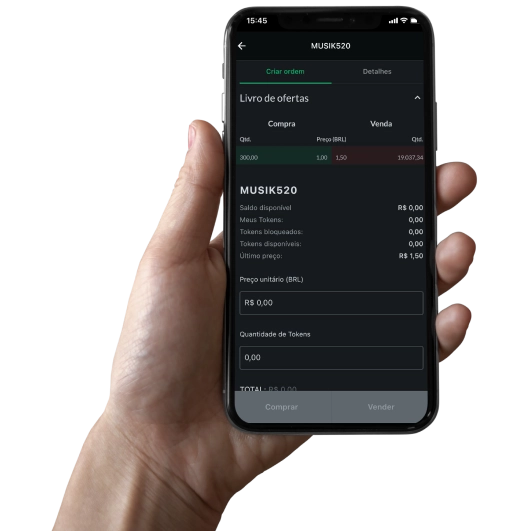

Nossa Plataforma

+30.000

Investidores em 10 países.

+200

Empresas utilizando a plataforma.

+1 Bilhão

Já originados para nossos clientes

Vantagens

A tokenização de ativos de investimento traz várias vantagens para os investidores e emissores. Para os investidores, ela permite o acesso a novas oportunidades de investimento, com maior transparência e liquidez. Para os emissores, ela oferece uma forma de captação de recursos mais eficiente, com menor custo e maior alcance.

Transparência

Obtenha transparência de ponta a ponta, toda a estrutura de capital, securitização e serviço de facilidades de dívida são colocados on chain

Diversificação

Diversifique as garantias de stablecoin e do tesouro com rendimento correlacionado aos ativos do mundo real.

Segurança

Um protocolo com fortes requisitos regulatórios e de conformidade - KYC, verificações de investidores credenciados

ROAs

1 a 5% para venda de tokens

Comissão

Até 5% para envio de operações tokenizadas

HCU

Prêmio em HCU para venda e participação ativa no projeto

“Estamos migrando para uma economia tokenizada. Nós estamos bastante avançados nessa jornada em direção a um sistema financeiro mais integrado e mais digital”

Roberto Campos Neto - Presidente do BC

https://febrabantech.febraban.org.br/temas/inovacao/estamos-migrando-para-uma-economia-tokenizada-diz-presidente-do-bcProcesso de Tokenização

O processo de tokenização começa com a seleção do ativo a ser tokenizado. Pode ser qualquer ativo financeiro, como ações, títulos, commodities, imóveis, entre outros. Em seguida, o ativo é transformado em um token digital, que é então registrado em um blockchain. O token é então emitido e disponibilizado para compra pelos investidores.

1

Proprietário do Ativo

KYC / AML

3

Custodia de Ativos

Securitização

5

Blockchain

Emissão de token

2

Originador

Auditoria do ativo

4

Hurst Capital

Oferta de token

6